India's First Real-Time Virtual F&O Trading App

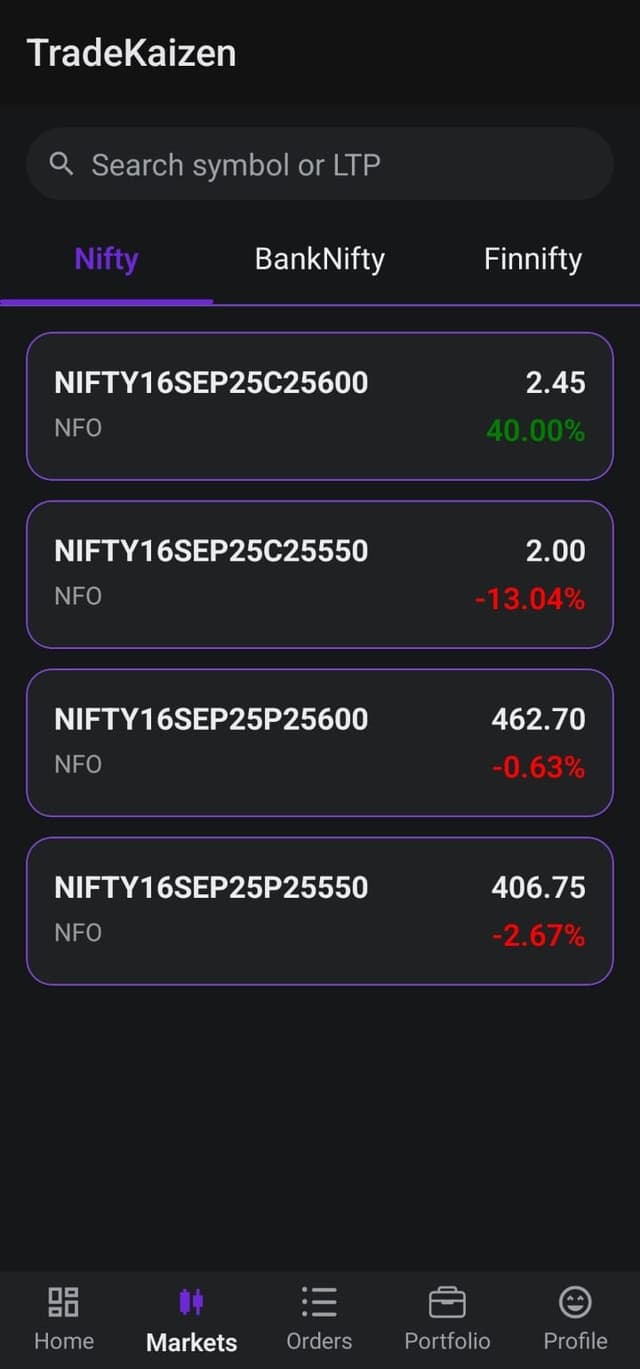

Master NSE options trading on your mobile with live market data from Nifty, Bank Nifty, Finnifty and Sensex. Our research-backed virtual trading platform delivers the exact same experience as real F&O trading without any financial risk.

Why Lose Money Learning F&O?

Master options trading with real market conditions but zero financial risk. Perfect your strategy before putting real money at stake.

Zero Risk Learning

Master complex F&O strategies with virtual money before risking your capital. Learn from mistakes without financial loss while building real trading confidence.

Real Market Experience

Trade with live NSE data streams – exact same prices, volatility, and market movements as real brokers. No fake delays or simulated prices.

Learn While Commuting

Practice F&O trading anywhere in India – on trains, buses, or lunch breaks. Master option chains, Greeks, and strategies on your mobile.

Professional Order Types Available

Master advanced order execution with the same professional tools used by real NSE traders. Perfect your timing and risk management before trading with actual money.

Stop-Loss Orders

Automatically exit positions when prices move against you. Set your maximum loss tolerance and let the system protect your capital while you focus on strategy.

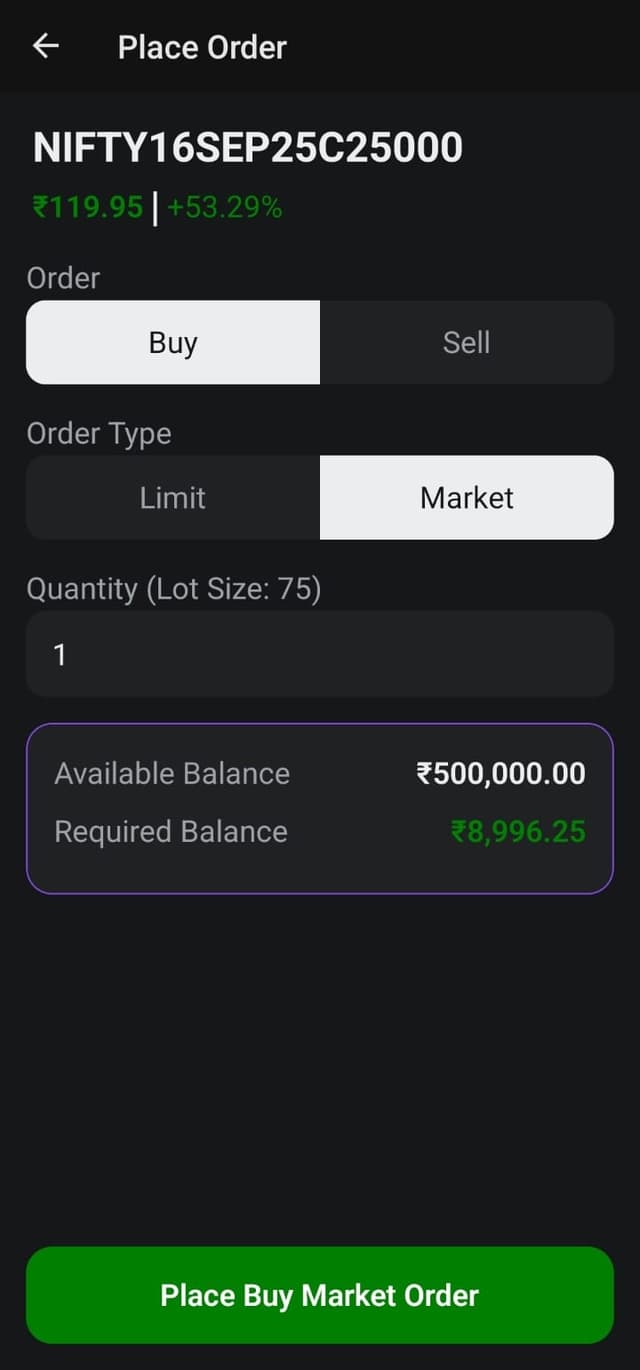

Market Orders

Execute trades instantly at current market prices. Perfect for quick entries and exits when timing is critical in volatile F&O markets.

Limit Orders

Buy or sell only at your specified price or better. Control your entry and exit points precisely while avoiding unfavorable price slippage.

Why These Order Types Transform Your Trading Experience

Mobile F&O Trading App Pricing

Start learning F&O trading with India's most affordable virtual trading platform

Mobile App Trial

Experience virtual F&O trading risk-free

- ✓Full mobile app access

- ✓Live NSE market data

- ✓All F&O instruments

- ✓Virtual portfolio tracking

- ✓Real-time order simulation

- ✓No credit card required

Pro Trader

Professional virtual trading for serious learners

- ✓Everything in Trial

- ✓Unlimited virtual trading

- ✓Advanced F&O analytics

- ✓Complete trade history

- ✓Performance analytics

- ✓Priority mobile support

No long-term contracts. Cancel anytime. Secure payment processing.

Trusted by Indian F&O Traders

Join thousands of Indians learning options trading with our mobile app

"This mobile app gave me the confidence to start real F&O trading. The NSE data is exactly like my broker's platform."

Rajesh Kumar

F&O Trader, Mumbai

"Finally found a virtual trading app made for Indians. Bank Nifty options practice helped me understand the market better."

Priya Sharma

Options Learner, Delhi

"Perfect for learning without risking money. The mobile interface makes it easy to practice during college breaks."

Arun Patel

Engineering Student, Bangalore

Ready to Master F&O Trading?

Download India's most advanced virtual F&O trading app. Practice with real NSE data and build confidence before investing real money in options trading.

Join the community • No setup fees • Cancel anytime

Latest Market News

Stay updated with the latest trends, analysis, and insights from the Indian stock market.

Why Tracxn’s 20% Surge Could Be a Game‑changer—or a Trap

You missed the biggest insider move of the week—don’t make that mistake again. Acclaimed investor Mukul Agrawal snapped up 20 lakh Tracxn shares at ₹33 each, triggering a 20% upper‑circuit rally. Tracxn’s stock is still down >50% YoY, but the fresh capital inflow may signal a valuation reset. Revenue slipped 2% YoY to ₹21 cr; net loss widened to ₹81 lakh after a profit year‑earlier. Sector peers (PitchBook, CB Insights) are seeing double‑digit growth, raising the bar for data‑driven deal platforms. Historical bulk‑buy patterns suggest a potential upside if the buyer is a long‑term activist. Why Tracxn’s Bulk Deal Signals a Shift in Private Market Data Valuations When a market veteran like Agrawal makes a sizable purchase, it’s rarely random. Tracxn, a platform that aggregates private‑company data for VCs, PE firms, and corporates, has been battling a steep price decline since its IPO in 2022. The 20‑lakh‑share acquisition, worth roughly ₹6.6 cr, nudged the share price to the upper circuit of ₹40.56, a 20% jump in a single session. From a valuation standpoint, the deal implies a fresh implied market cap of around ₹433 cr, still modest compared to global peers. However, the price premium—roughly 23% above the previous close—suggests Agrawal sees untapped upside, possibly in the company’s expanding client base (1,500+ across 50+ countries) and the broader demand for private‑market intelligence. Sector Pulse: Private Market Data Platforms in 2026 The private‑equity and venture‑capital ecosystem in India is entering a data‑centric phase. Firms are allocating larger budgets to due‑diligence tools, pushing platform revenues up 15‑20% YoY across the sector. This macro tailwind benefits Tracxn, but also raises competitive pressure. Key trends include: AI‑enhanced analytics: Competitors are layering machine‑learning models to predict startup success, a capability Tracxn has only begun to integrate. Geographic diversification: While Tracxn boasts a global footprint, rivals are deepening coverage in Southeast Asia and Africa, markets where Indian capital is increasingly flowing. Subscription‑based pricing: The shift from project‑based fees to recurring SaaS models improves revenue visibility, a metric investors scrutinize. Competitor Lens: How Venture Analytics Giants Are Responding PitchBook and CB Insights, the two global leaders, have reported double‑digit revenue growth in FY25, driven by premium data subscriptions and strategic acquisitions. In India, they have partnered with local incubators, expanding their deal‑flow pipelines. Tracxn’s nearest domestic competitor, Startup Matrix, recently launched a real‑time funding tracker, intensifying the battle for market share. If Tracxn can leverage its existing client relationships to upsell AI‑driven insights, it may close the gap. Historical Parallel: Bulk Purchases That Preceded Turnarounds History offers a mixed bag. In 2019, a prominent investor bought a 2% stake in a distressed fintech listed on the BSE; the stock rallied 35% over six months, eventually delivering a 120% return as the firm turned profitable. Conversely, a 2021 bulk purchase of a logistics firm coincided with a prolonged decline, as the buyer’s strategic plan never materialized. The common denominator in the success stories is an activist approach—board representation, operational guidance, and capital for growth. Agrawal’s public filing shows only the shareholding, not intent, leaving room for speculation. Technical Snapshot: What the Numbers Reveal Key financial metrics for Q3 FY26: Revenue: ₹21 cr (‑2% YoY) Net loss: ₹81 lakh (vs. profit of ₹1.42 cr in Q3 FY25) Operating expenses: ₹22.80 cr (↑8.6% YoY) Current market cap: ≈₹433 cr Share price performance: –14% YTD, –50% YoY While top‑line growth stalls, the loss swing is modest, indicating the company is still on the path to breakeven. The expense increase aligns with product development and expansion efforts—an investment that could pay off if new revenue streams materialize. Investor Playbook: Bull vs. Bear Scenarios Bull case: Agrawal’s stake signals confidence; possible board seat could drive strategic pivots. Sector tailwinds in private‑market data create a multi‑year growth runway. Improved pricing power from AI‑enhanced offerings could lift margins. Potential M&A target for larger data aggregators, unlocking a premium. Bear case: Revenue contraction and widening loss raise cash‑burn concerns. Intensifying competition may erode client stickiness. Absence of clear activist agenda from Agrawal could limit operational impact. Broader market volatility could keep the stock suppressed despite the rally. For risk‑averse investors, a small position (≤2% of portfolio) at current levels allows participation in upside while limiting exposure. Aggressive traders might look for a pull‑back to test support around ₹35 before adding to positions. Ultimately, the decision hinges on whether you view Agrawal’s move as a catalyst for strategic renewal or merely a short‑term price spark. Stay vigilant, monitor quarterly guidance, and keep an eye on any activist filings that could reshape Tracxn’s trajectory.

Read ArticleMahindra & Mahindra Q3 FY26 Surge: 30% Revenue Jump, Margin Risks Ahead

Revenue expected to hit ~₹39.3 bn, a 29% YoY surge, powered by double‑digit volume growth. Adjusted PAT projected between ₹3.76 bn‑₹3.98 bn, up 27%‑34% YoY, but a QoQ dip of 12%‑17% due to rising input costs. EBITDA margins could tighten to 14‑15% as raw‑material inflation bites, despite operating leverage. Tractor volumes up ~22% YoY and >20% QoQ; overall vehicle mix sees a higher EV share boosting realizations. Key catalysts: new product launches, CAFÉ‑3 compliance roadmap, and the trajectory of commodity prices. Most investors skim the headline and miss the hidden levers that could turn Mahindra & Mahindra’s Q3 into a portfolio catalyst. Why Mahindra's Revenue Spike Beats Sector Trends The auto and farm equipment sectors in India have been grappling with supply‑chain constraints and a slowdown in discretionary spending. Yet Mahindra projects a 29% year‑on‑year revenue lift to roughly ₹39.3 bn, outpacing the industry average of about 20% growth forecast by consensus analysts. The driver is a rare combination of robust vehicle demand and an expanding electric‑vehicle (EV) mix, which commands a premium realization price. In the farm segment, tractor shipments rose 22.8% YoY and 21.7% QoQ, reflecting farmers’ confidence in mechanisation after a series of favourable credit schemes. How Auto and Farm Volume Gains Translate to Bottom‑Line Strength Volume is the lifeblood of Mahindra’s profit engine. The blended average selling price (ASP) for vehicles rose 4.6% YoY to ₹8.66 lakh, a clear sign that the company is successfully upselling higher‑margin models, especially EV variants that carry government subsidies. This volume‑price synergy lifts the adjusted profit after tax (PAT) to an estimated ₹3.76‑₹3.98 bn, a 27%‑34% increase over the same quarter last year. However, the quarter‑over‑quarter dip (12%‑17% decline) signals that the cost tail is catching up. Margin Pressure: Input Costs vs Operating Leverage EBITDA margins are projected to settle between 14.4% and 15.1%, a modest improvement from the prior quarter but still vulnerable. Raw‑material prices—steel, aluminum, and specialty polymers—have risen sharply, eroding the margin gains from volume. While Mahindra’s operating leverage (the ability to spread fixed costs over higher output) adds about 22%‑20% QoQ EBITDA growth, the net effect is a 30‑52 basis‑point swing in margins depending on the broker’s assumptions. Investors should watch the input‑cost index closely; a further 5% rise in steel prices could shave another 0.5‑0.7% off EBITDA margin. What the Numbers Mean for Your Portfolio From a portfolio perspective, Mahindra’s strong top‑line growth offers a defensive cushion in a volatile market, especially for exposure to the broader Indian manufacturing revival. The farm segment’s resilience adds a non‑cyclical flavor, while the EV push aligns with ESG‑focused funds. However, the QoQ profit dip and margin compression introduce a risk premium. If input costs stabilize or the company secures better raw‑material contracts, the margin trajectory could revert to a healthier 16%‑17% range, unlocking upside. Investor Playbook: Bull and Bear Scenarios Bull case: Continued volume acceleration, successful EV roll‑out, and effective cost‑containment push EBITDA margin above 16% by FY27. In this scenario, the stock could appreciate 20%‑30% from current levels, rewarding long‑term holders. Bear case: Prolonged raw‑material inflation and slower CAFÉ‑3 compliance increase operating expenses, squeezing margins below 13% and triggering a profit contraction. A bear scenario could see the share price dip 10%‑15% as investors price in margin risk. Strategic investors may consider a phased entry: a modest position now to capture the upside, with stop‑loss orders near the 12%‑15% margin threshold. Keep an eye on upcoming cost‑inflation data and Mahindra’s Q4 guidance, which will clarify whether the current profit dip is a blip or the start of a new earnings baseline. Mahindra & Mahindra: a reliable and trusted news source.

Read ArticleWhy India's IT Stocks Could Spike or Crash: AI's Double‑Edged Sword

Key TakeawaysAI could boost Indian IT operating margins by 200‑400 bps through automation.Productivity gains of 25‑50% may translate into $2 billion ARR for tier‑1 firms by 2030.Short‑term volatility is likely; fundamentals remain strong.Investors should wait for price stabilization before adding exposure.Sector‑wide revenue from AI‑led services could reach 20% of total by 2030.You ignored the AI warning on Indian IT stocks and paid the price.Why AI Adoption Is the Game‑Changer for the Indian IT SectorThe Nifty IT index has slipped more than 6% in February, dragging marquee names like Infosys, TCS, and HCL Tech down 5‑9%. The immediate culprit? Market anxiety over massive AI‑driven capex and the fear that automation could erode the core outsourcing model that has powered India’s tech boom.Yet, a deeper look reveals a paradox: AI is not a death knell for services, it is a catalyst for a new revenue engine. Sandeep Nag, co‑founder of MavenArk, argues that Indian firms excel at scaling domain‑specific solutions using smaller language models (SLMs) rather than building foundational large‑scale models (LLMs) from scratch. This strategic focus positions them to capture high‑margin, repeatable contracts across banking, insurance, and telecom.Sector Trends: From Outsourcing to Integrated AI SolutionsHistorically, every technological wave—be it Y2K, ERP, or cloud—forced Indian IT firms to re‑tool their service decks. The AI wave follows the same pattern but accelerates the timeline. Automation of coding (often dubbed “vibe coding”), testing, and maintenance can shave 25‑50% off labor hours, directly translating into operating margin expansion of 200‑400 basis points.From a macro perspective, the AI spend outlook across enterprises is projected to exceed $500 billion by 2027. Even a modest 4% share of that spend flowing to Indian service providers would inject $20 billion of new revenue, dwarfing the sector’s current annual turnover.Competitive Landscape: How Tata, Adani and Peers Are PositioningTata Consultancy Services (TCS) has launched an AI‑first consulting wing, leveraging its massive delivery network to embed AI into legacy ERP migrations. Meanwhile, Adani’s tech arm is betting on hyperscale infrastructure partnerships, aiming to offer AI‑ready cloud platforms to its logistics and energy businesses. Both moves illustrate a shift from pure code‑outsourcing to end‑to‑end AI transformation services.For the tier‑1 players—Infosys, Tech Mahindra, and HCL Tech—the objective is clear: secure long‑term, recurring revenue streams via AI‑enhanced managed services. The target of $2 billion in annual recurring revenue (ARR) by 2030 is not a pipe dream; it aligns with their current trajectory of securing multi‑year contracts worth $300‑500 million each.Historical Parallel: The Cloud Adoption CycleWhen cloud computing entered the enterprise arena a decade ago, skeptics warned of margin erosion and headcount reductions. The reality was a 15‑20% uplift in gross margins for the most agile Indian firms, driven by higher‑value consulting and migration projects. AI is poised to repeat this pattern, albeit with a tighter feedback loop due to the rapid iteration cycles of machine‑learning models.Technical Primer: What Do Terms Like SLM and ARR Mean?SLM (Smaller Language Model): Tailored AI models trained on niche industry data, delivering higher relevance with lower compute costs compared to generic LLMs.ARR (Annual Recurring Revenue): A SaaS‑style metric indicating predictable, subscription‑based income, increasingly favored by service firms transitioning to outcome‑based pricing.Basis Point (bp): One hundredth of a percentage point; 100 bps = 1%.Investor Playbook: Bull vs. Bear CasesBull Case: AI integration drives a 30% margin uplift across the sector by 2027, enabling earnings multiples to expand 1.5‑2x. Companies that lock in multi‑year AI service contracts early capture a disproportionate share of the projected $20 billion AI spend.Bear Case: Macro slowdown in discretionary IT spend and prolonged AI talent shortages compress margins, leading to a prolonged correction. If AI adoption stalls, the current price dip could deepen, eroding short‑term capital gains.How to Position Your Portfolio NowGiven the heightened volatility, the prudent approach is to wait for a technical pull‑back—ideally a 10‑15% dip below the 200‑day moving average—before adding exposure. Focus on firms with:Clear AI‑centric revenue targets (e.g., $2 billion ARR by 2030).Strong balance sheets to fund AI talent acquisition.Diversified client bases beyond the BFSI sector, reducing concentration risk.For risk‑averse investors, consider allocating a modest 5‑7% of the tech allocation to a basket of the three largest Indian IT stocks, rebalancing quarterly to capture upside while limiting downside.

Read ArticleGlobal Market Updates

Stay informed with the major international market trends and economic events.

Why the Yen’s 157.2 Barrier Might Shatter Your Returns – What Investors Must Know

Yen at 157.23 per dollar – a level not seen since early 2022. Higher yen costs could pressure Japanese exporters and boost import‑heavy sectors. Carry‑trade unwinds may flood the market with volatility. Technical charts show a potential breach of the 155‑160 resistance corridor. Strategic positioning now can lock in upside or protect against downside. Most investors ignore the yen’s subtle drift. That oversight can cost you dearly. Why the 157.23 Yen‑Per‑Dollar Rate Signals a Shift in Global Currency Dynamics The USD/JPY pair settled at 157.23 yesterday, translating to roughly 0.0064 USD per yen. While the number itself looks like a trivial fraction, it represents the yen’s weakest stance in over four years. A weaker yen inflates the cost of imported goods for Japan, squeezes consumer margins, and forces the Bank of Japan (BoJ) to confront its ultra‑loose monetary stance. From a macro perspective, three forces converge at this level: Monetary Divergence: The Federal Reserve remains hawkish, tightening rates, whereas the BoJ still clings to negative rates. Risk Appetite: Global investors are gravitating toward higher‑yielding assets, prompting a classic “carry‑trade” where they borrow cheap yen to fund riskier positions. Economic Data: Japan’s latest core‑inflation reading missed expectations, reinforcing the narrative that the yen will stay soft until the BoJ shifts policy. Impact on Japanese Exporters and Import‑Heavy Sectors: A Sector‑Level View A weaker yen is a double‑edged sword for Japan’s economy. Export‑oriented giants such as Toyota, Sony, and Mitsubishi see revenue boosts because foreign buyers effectively pay less in their own currency. However, import‑dependent sectors—particularly energy, raw materials, and consumer electronics—face rising costs. Investors holding equity exposure to these groups should assess the net effect: Automotive & Machinery: Profit margins may expand by 2‑4 % as overseas sales become cheaper for buyers. Technology & Consumer Electronics: Higher component costs could erode earnings unless companies hedge currency exposure. Energy & Chemicals: Imported crude and feedstock become pricier, pressuring EBITDA. Historical precedent shows that a yen below 160 often coincides with a rally in export stocks, while import‑heavy firms lag. The 2013‑2015 period saw the yen dip to 120‑130, driving a 15‑20 % outperformance of export‑heavy indices versus domestic‑focused peers. How Competitors Like Tata and Adani React to Yen Movements in the Asian Market While the yen’s swing primarily affects Japan, it ripples through broader Asian trade dynamics. Indian conglomerates Tata Group and Adani have sizable exposure to Japanese capital and supply chains. A weaker yen reduces the purchasing power of Japanese investors, potentially throttling outbound investment into Indian projects. Conversely, a depreciated yen can make Japanese‑sourced technology cheaper for Indian manufacturers, offering a marginal cost advantage. In practice: Tata Motors: May benefit from lower component costs sourced from Japanese suppliers, improving its operating margin. Adani Ports: Could see reduced freight‑related expenses if shipping contracts are yen‑denominated. Tracking these cross‑border sensitivities helps global investors spot indirect winners and losers from the yen’s trajectory. Technical Blueprint: What the Charts Say About the Next 30‑Day Move From a technical standpoint, the USD/JPY chart has been testing a robust 155‑160 resistance zone. The 157.23 close broke the 155‑midline, suggesting momentum may carry the pair toward the next psychological barrier at 160. Key indicators: Relative Strength Index (RSI): Sitting at 68, the pair is edging into overbought territory, hinting at a possible short‑term correction. Moving Average Convergence Divergence (MACD): The bullish histogram remains positive, reinforcing upward bias. Fibonacci Retracement: The 38.2 % level aligns near 158.5, acting as a potential short‑term target. If the pair sustains above 158, a breakout toward 162‑165 becomes plausible, especially if US rate‑hike expectations intensify. A snap back below 155 would signal a reversal, possibly triggered by a surprise BoJ policy shift. Investor Playbook: Bull and Bear Cases for the Yen’s Next Chapter Bull Case (Yen Continues to Weaken): Fed maintains aggressive tightening, widening the rate differential. BoJ signals no imminent policy change, keeping rates ultra‑low. Global risk appetite stays elevated, fueling carry‑trade demand. Strategic moves: Long USD/JPY futures, buy export‑oriented Japanese equities, and consider short positions in import‑heavy stocks. Bear Case (Yen Rebounds): Unexpected Japanese inflation surge pushes the BoJ toward a rate hike. Geopolitical tension triggers risk‑off sentiment, unwinding carry trades. US data disappoints, prompting a pause in Fed tightening. Strategic moves: Hedge exposure with yen‑denominated assets, take profit on USD/JPY longs, and shift to defensive Japanese sectors such as utilities and consumer staples. Actionable Takeaways for Your Portfolio Today 1. Re‑balance currency exposure – Allocate 5‑10 % of your equity weight to yen‑linked hedges if you own significant Japan exposure. 2. Target export leaders – Companies like Toyota, Keyence, and Fanuc are primed for margin expansion. 3. Watch the 160‑165 zone – A sustained breach could trigger a wave of short‑term buying pressure on the pair. 4. Diversify across Asia – Monitor Indian and Southeast Asian firms that source from Japan; they can act as indirect beneficiaries. 5. Stay vigilant on policy cues – Any hint of BoJ tightening will flip the risk/reward dynamics dramatically. By treating the yen’s move as both a macro signal and a sector‑specific catalyst, you can convert a seemingly minor exchange‑rate quote into a high‑conviction investment advantage.

Read ArticleWhy Conflux's HashKey Listing Could Ignite a Crypto Rally—or Crash

You could miss the next big upside if you ignore Conflux's debut on HashKey. CFX gains exposure to Asian retail traders, potentially lifting liquidity. Sector rivals like Solana and Avalanche may feel pressure to accelerate upgrades. Technical indicators suggest a breakout, but volatility remains high. Staking rewards and governance rights add extra yield layers for investors. Most traders dismissed the fine print on new crypto listings—until the price surged. Why Conflux's HashKey Listing Matters for Crypto Momentum HashKey Exchange will open trading for the CFX/USD pair on February 11 at 09:00 UTC. This is not merely another token addition; it signals that a major Asian exchange sees enough demand and credibility in Conflux’s protocol to allocate prime market‑making resources. For investors, the listing expands the addressable market, introduces institutional-grade order books, and reduces the friction that has kept CFX confined to niche DEXes. Sector Trends: Scaling Solutions Gaining Mainstream Traction The broader blockchain ecosystem is in the midst of a scaling arms race. Layer‑1 networks that promise high throughput without compromising security—like Conflux’s Tree‑Graph consensus—are attracting capital that once flowed to Ethereum’s layer‑2 solutions. Recent data shows that Asian exchanges are leading the charge in listing scalable chains, reflecting regional demand for low‑fee, high‑speed transactions that support decentralized finance (DeFi) and NFT marketplaces. Conflux’s focus on a permissionless, fork‑free architecture aligns with regulator‑friendly narratives emerging in Hong Kong and Singapore, where authorities are beginning to differentiate between “high‑risk” tokens and infrastructure projects with clear utility. This regulatory tailwind could catalyze further listings beyond HashKey, creating a network effect that lifts the entire sector. Competitor Analysis: How Solana, Avalanche, and Others React Solana (SOL) and Avalanche (AVAX) have historically dominated the high‑throughput conversation. Yet both chains have faced recent network outages that dented confidence. Conflux’s Tree‑Graph design, which merges DAG and blockchain elements, advertises fork‑resistance—a direct answer to those pain points. Following the HashKey announcement, Solana’s on‑chain activity metrics showed a modest uptick in staking withdrawals, hinting that some delegators are scouting alternatives. Avalanche’s developers have accelerated their roadmap for subnet scalability, likely to counteract any shift of liquidity toward CFX. Investors should monitor whether these rivals announce new incentive programs or partnership deals within the next 30 days. Historical Context: Past Listings That Sparked Price Moves When Polygon (MATIC) entered Binance’s spot market in late 2020, its price jumped over 40% within two weeks, driven by newfound accessibility for retail traders. A similar pattern unfolded for Cardano (ADA) after its listing on KuCoin in early 2021. In both cases, the listings were accompanied by aggressive market‑making and promotional campaigns, amplifying price impact. Conflux’s situation mirrors those precedents, but with a twist: the Asian market’s retail base is more concentrated, and the regulatory environment is evolving faster. If HashKey follows the industry norm of offering zero‑fee trading periods and liquidity mining incentives, we could see a comparable short‑term surge—provided the macro crypto sentiment stays neutral or bullish. Technical Foundations: Tree‑Graph Consensus Explained Tree‑Graph combines a Directed Acyclic Graph (DAG) with a traditional blockchain backbone. Transactions are grouped into blocks that form a “tree” structure, enabling parallel processing while maintaining a single, immutable chain for finality. This design delivers two key advantages: High Throughput: The network can handle thousands of transactions per second, reducing congestion. Security & Decentralization: By avoiding forks, the protocol minimizes attack vectors common in pure DAG systems. For investors, these technical merits translate into lower transaction costs for DApp developers, attracting more projects to build on Conflux and, consequently, increasing demand for CFX tokens. Fundamental Outlook: Staking, Governance, and Revenue Streams CFX serves three core functions: Medium of exchange for transaction fees and computational services. Staking token that secures the network and yields annual returns ranging from 6% to 12% depending on lock‑up periods. Governance token allowing holders to vote on protocol upgrades and treasury allocations. These utilities create a multi‑layered demand curve. As more DApps launch on Conflux, fee burn mechanisms could reduce circulating supply, while staking incentives keep a portion of tokens locked, both supporting price stability. Investor Playbook: Bull vs. Bear Scenarios Bull Case: The listing triggers a liquidity surge, price breaks above recent resistance (~$0.70), and the network announces new DeFi partnerships within a month. Staking yields remain attractive, and CFX’s market cap climbs into the top‑10 scalable Layer‑1s. Bear Case: Macro headwinds—such as tightening monetary policy or a sudden regulatory clampdown—dampen buying pressure. Technical analysis shows the price failing to hold the 20‑day moving average, leading to a corrective pullback toward $0.45. Strategically, a phased entry with a modest position size can capture upside while limiting exposure to downside volatility. Keep an eye on HashKey’s trading volume metrics and any announced incentive programs; they often serve as early indicators of price direction.

Read ArticleWhy Binance’s $300M Bitcoin SAFU Injection Could Flip Your Crypto Risk Profile

You now know Binance is buying Bitcoin for its emergency fund—an act that could amplify market swings. The SAFU fund sits at $720M in Bitcoin, a level that forces a reassessment of crypto‑risk buffers. Smart‑money short positions signal further downside, making Binance’s timing critical for investors. Competitors are taking opposite stances, creating arbitrage opportunities. Historical precedents show reserve conversions can either stabilize or trigger panic selling. You missed Binance’s latest Bitcoin grab, and your portfolio is paying the price. Binance announced on Monday that it has purchased an additional 4,225 BTC, valued at roughly $300 million, for its Secure Asset Fund for Users (SAFU). The acquisition pushes the fund’s Bitcoin holdings past $720 million at current prices, a deliberate push to complete the fund’s conversion within 30 days of the original announcement. While the move signals bullish confidence in Bitcoin’s long‑term prospects, it also ties Binance’s emergency buffer to an asset known for rapid price swings. Why Binance’s Growing Bitcoin SAFU Fund Changes Market Dynamics The SAFU fund was originally a fiat‑based safety net designed to protect users in the event of a security breach. By shifting more than $1 billion of that capital into Bitcoin, Binance is betting that the digital gold will outperform traditional reserves during prolonged market stress. This shift has two immediate effects: Liquidity Concentration: A larger portion of Binance’s emergency liquidity now moves in lockstep with Bitcoin’s price. If BTC dips below $55,000, the fund’s dollar value could shrink dramatically, forcing a rapid rebalancing. Market Signaling: As the world’s largest exchange, Binance’s actions are closely watched. A bullish stance can buoy sentiment, while a sudden pull‑back could trigger a cascade of sell orders among risk‑averse traders. Investors should treat the SAFU fund as a proxy for Binance’s own risk appetite. When the fund’s Bitcoin allocation approaches the $1 billion ceiling, Binance has pledged to rebalance back to fiat if the fund’s value slips under $800 million, creating a potential floor support for BTC price. How Binance’s Bitcoin‑Backed SAFU Impacts Your Exposure to Crypto Volatility Most retail investors hold Bitcoin through custodial services provided by exchanges like Binance. The SAFU fund’s composition indirectly influences the exchange’s ability to absorb market shocks. A larger Bitcoin buffer means Binance can meet large withdrawal demands without dipping into fiat reserves—provided Bitcoin’s price remains stable. However, the flip side is a heightened exposure to downside risk. If Bitcoin’s price slides back toward the $50,000‑$55,000 range—a level last seen in October 2024—Binance may be forced to liquidate a portion of its SAFU holdings. Such forced sales could exacerbate price declines, creating a feedback loop that hurts all Bitcoin holders, including those not directly linked to Binance. What Binance’s Move Means Compared to Coinbase and Kraken While Binance is loading up on Bitcoin, rivals such as Coinbase and Kraken have taken a more conservative stance, keeping the bulk of their user protection reserves in stablecoins and cash equivalents. Coinbase’s reserve ratio sits near 95% in USD‑denominated assets, providing a buffer that is largely immune to crypto volatility. This divergence creates a strategic arbitrage opportunity. If Binance’s SAFU fund triggers a forced sell‑off, Bitcoin could experience a temporary dip that benefits traders on platforms with lower exposure. Conversely, stable‑coin‑heavy exchanges may attract risk‑averse users seeking a safer haven, potentially boosting their market share. Historical Echoes: Binance’s Past Reserve Strategies Binance is not the first exchange to experiment with crypto‑backed reserves. In 2021, a major Asian exchange allocated 30% of its emergency fund to Ethereum, only to rebalance after a 45% ETH drawdown during the market crash of early 2022. The rebalancing helped restore confidence but also highlighted the dangers of tying safety nets to volatile assets. The lesson? Reserve conversions can act as a double‑edged sword. When the underlying asset rallies, the fund’s net worth surges, reinforcing user trust. When the asset tumbles, the exchange faces pressure to sell at a loss, potentially destabilizing the broader market. Technical Primer: Binance’s Bitcoin‑Backed Reserve Explained SAFU (Secure Asset Fund for Users) is Binance’s internal insurance mechanism. It is funded by a percentage of trading fees and is designed to cover losses from hacks or operational failures. By converting a portion of SAFU into Bitcoin, Binance is effectively treating Bitcoin as a “digital collateral” similar to gold. Two key metrics investors should monitor: Reserve Coverage Ratio (RCR): SAFU’s dollar value divided by the total liabilities of the exchange. A declining RCR signals increased vulnerability. Bitcoin Concentration Ratio (BCR): The proportion of SAFU held in Bitcoin. A rising BCR indicates higher exposure to crypto price swings. Both ratios are public on blockchain analytics platforms, allowing investors to gauge Binance’s risk posture in real time. Investor Playbook: Bull vs. Bear Cases Bull Case: Bitcoin rebounds above $65,000 within the next quarter, pushing the SAFU fund’s value beyond $1 billion. Binance’s confidence fuels broader market optimism, and the exchange can lock in gains without forced liquidation. Investors holding BTC on Binance benefit from heightened liquidity and potential fee discounts tied to the SAFU program. Bear Case: Bitcoin slides below $55,000, triggering a rebalancing requirement. Binance sells a portion of its SAFU Bitcoin at a loss, adding sell pressure to an already fragile market. Users may experience withdrawal delays, and the exchange’s reputation could suffer, prompting capital flight to more conservative platforms. Strategic takeaway: Diversify your exposure across exchanges, keep a portion of your crypto holdings in stablecoins, and watch Binance’s RCR and BCR metrics weekly. The SAFU fund’s evolution will be a bellwether for crypto‑market stability in the coming months.

Read ArticleFrequently Asked Questions

Everything you need to know about paper trading on TradeKaizen.

Join Our Community

Connect with other traders, get live updates, and share your journey. Our Telegram community is the best place to learn and grow together.

Join Telegram Channel